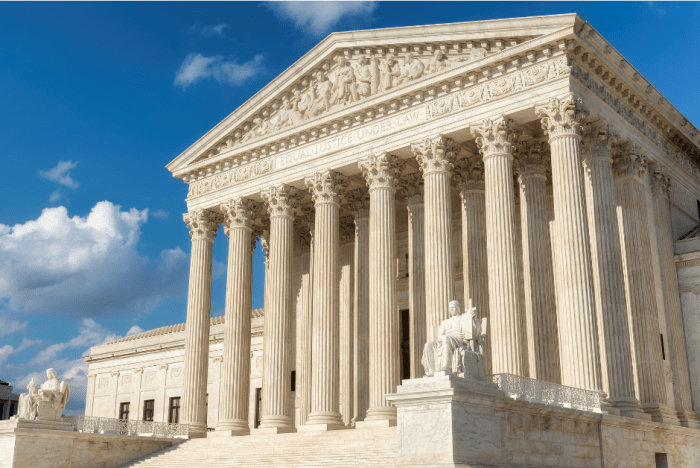

Last Friday, capping a week of consequential decisions — including a devastating ruling for higher education — the U.S. Supreme Court ruled that President Joe Biden’s student loan forgiveness plan was unconstitutional.

In a 6-3 decision on a case challenging Biden’s authority to cancel some $430 billion in student loan debt, the Supreme Court ensured nearly 1.4 million Texans who were poised to have some or all of their student debt forgiven will now have to resume payments on their loan balances.

The court’s conservative justices, led by Chief Justice John Roberts, sided with six Republican-led states that alleged Biden overstepped his authority in rolling out the plan that would have lightened the load of 43 million Americans.

The Biden Administration’s plan would have forgiven up to $10,000 in federal student debt for Americans who make less than $125,000 per year and up to $20,000 for the recipients of federal Pell grants.

The administration claimed authority to do so under a 2003 federal law — the Higher Education Relief Opportunities for Students Act, or HEROES Act — which lets the education secretary “waive or modify” student financial assistance during war or national emergencies.

What’s Next on Student Debt

In responding to the court’s decision, Biden also announced a new plan of attack to complete his campaign promise of providing relief to borrowers.

“Today’s decision has closed one path. Now we’re going to pursue another,” Biden said, announcing steps being taken under the Higher Education Act. “I’m never going to stop fighting for you. We’ll use every tool at our disposal to get you the student debt relief you need — and reach your dreams.”

The Higher Education Act (HEA) of 1965 provides government-backed student loans and grants the Department of Education the ability to “compromise, waive, or release loans.” Secretary of Education Miguel Cardona has been tasked with creating a legal workaround for debt forgiveness using his authority under the HEA.

In the interim, the Biden Administration is working to implement an income-driven repayment plan and establish a 12-month “on-ramp” period to help borrowers when student loan repayments resume in October. That transitional plan is intended to prevent lenders from immediately reporting missed payments to credit agencies.

What You Need to Know

Nothing in this decision changes what is happening with the Public Service Loan Forgiveness program.

You are still able to set up income-driven repayment plans through the overhauled PSLF program. Additionally, you can still take advantage of a limited-time waiver to have your previously ineligible payments counted toward PSLF, but you must act before Dec. 31, 2023.

AFT is here to help you navigate this complicated landscape with the Summer debt relief program, a free benefit for members, and our union’s ongoing student debt clinics.